Who knew that committing to doing good could wind up being so much work? As more organizations embrace sustainability and practices that reflect strong environmental, social, and governance (ESG) policies, many are finding that success in this world is by no means guaranteed.

You can say you’re going to change your business model to make it more sustainable and ESG-ready, but the cold, hard reality is that doing so efficiently can be difficult at best. There’s the planning involved, the teamwork required, the intricacies of governance and reporting. And then, of course, there’s the pressing need for value—ensuring that your efforts are actually paying off.

The good news is, these challenges have solutions, and organizations of all kinds have seen that sustainability, ESG, and profitability go hand in hand. Here, we take a look at why this is the case and the strategies companies are using to make their visions a reality.

What’s all this talk about Sustainability and ESG?

If you’re with an organization without an ESG program, you’re probably wondering what the fuss is about. What exactly is ESG, and why does it seem like everyone is talking about it?

Simply put, “Environmental, Social, and Governance” is a term describing three criteria many investors use to evaluate potential investments. While “sustainability” has to do with the idea that corporations should protect both people and the planet in their pursuit of growth and profitability, ESG is a way to measure and understand how companies are performing in this regard.

The 3 Pillars of ESG

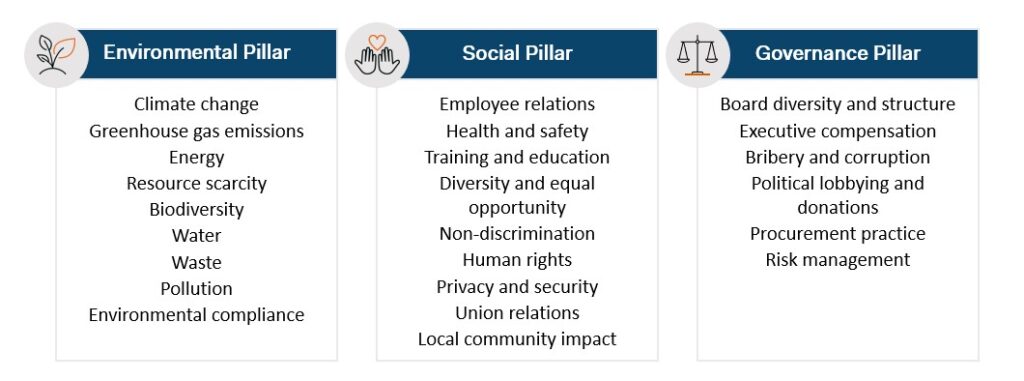

Investors are increasingly using ESG criteria to identify risks and growth areas for companies. Here are just a few of the major issues included under the three pillars of ESG.

1. Environmental: climate change, biodiversity, pollution, environmental compliance

2. Social: employee relations, non-discrimination, privacy and security, local community impact

3. Governance: board diversity and structure, political lobbying, risk management

Sustainability has exploded in popularity in recent years as consumers and other stakeholders look to align their purchases and investments with their personal values. At the same time, there’s been growing recognition that factoring ESG outcomes into financial decision making is a strategy for successful investment. As the effects of climate change become more tangible, and as more people demand progress around issues like diversity and equal opportunity, it’s become increasingly clear that success as a company often depends on success in ESG.

One recent study by the Global Sustainable Investment Alliance revealed sustainable investment assets under management worldwide now top $35 trillion. And another survey, by PwC, found that 77 percent of institutional investors intend to stop purchasing non-ESG products by the end of 2022. Meanwhile, our own research at Cority adds to the findings that organizations everywhere are getting the message that ESG is important. Globally, 72 percent of the firms we recently surveyed said they were now focused on sustainability collaboration across the value chain, and more than 9 in 10 said they were adapting their business strategies and models to be more sustainable.

While it’s easy to make promises around improving sustainability, execution can be another matter. In our work with companies that are attempting to develop effective and efficient sustainability and ESG strategies, we’ve found that they typically face five key challenges.

Materiality and stakeholder engagement

The first two major challenges—materiality and stakeholder engagement—tend to be tightly intertwined. As companies determine which ESG issues are most material to them, they must involve internal and external stakeholders in the process. This can be accomplished through a materiality assessment, which usually includes five steps: (1) defining the purpose and scope of the assessment; (2) creating a list of potential sustainability topics; (3) developing a method to weigh input from various stakeholders to permit ranking of these topics in order of importance; (4) soliciting that input through surveys and other data-gathering methods; and (5) analyzing the results and prioritizing topics via the chosen ranking method.

Sustainability governance

Governance activities in ESG and sustainability enable senior leaders to report key performance indicators with real-time data. They also allow them to monitor progress toward publicly stated goals, and to course-correct quickly if they find they’re not on track to meet their targets. These activities vary from company to company, but they usually fall into two distinct buckets: program governance and data governance. The big challenge when it comes to either category of governance: It all comes down to data collection and streamlining that process as much as possible.

Sustainability reporting

When it comes to sustainability and ESG reporting, we often hear from companies that they don’t know where to start. One potential problem is the sheer number of reporting frameworks and standards (more than 600 as of 2020) from which organizations have to choose, while another involves developing a reporting strategy that’s both efficient and aligned with their specific ESG objectives. With this in mind, the first step for many organizations is to take the time to answer four key questions:

- Why are you reporting?

- Where and to whom will you report?

- Which ESG frameworks will you follow? A

- And finally, how will you collect the data you need to report?

Deriving value from your sustainability program

Gone are the days when the typical corporate sustainability program was viewed by leadership as a company cost center. Today, organizations expect their sustainability initiatives to create value—to help them with everything from attracting and retaining talent to reducing energy consumption and expensive regulatory interventions. The challenge here, as with the other areas, is to ensure that your program is well aligned with your company’s mission and goals, and to push for value creation through best management practices that prioritize sustainability up and down the supply chain.

Using technology to drive Sustainability and ESG success

While the smallest companies might find that they’re able to manage their sustainability and ESG initiatives without specialized technology, such tools are indispensable for everyone else. An ESG-specific platform can, among other things, automate much of the materiality assessment process, facilitate data collection and reporting, and be used to identify those aspects of a program where changes might drive significant improvements. Sustainability software will play an increasingly important role as investor pressure grows for auditable, financial-grade data. Check out our eBook with recommendations on how to find the best software to meet your company’s sustainability goals.

Ultimately, companies that rely on these systems say that they’re key to accuracy and efficiency—that they reduce time spent collecting and correcting data while increasing opportunities for understanding what the data means. Can automation of your sustainability-focused processes guarantee that your ESG program will succeed? The answer there is probably not, but you can be sure that it’s going to help.

Learn more about Sustainability and ESG

Sustainability and ESG is a journey. To get a sense how far along you and your peers are in this journey today, we conducted research with independent research firm, Verdantix, to find out the current state of corporate sustainability and ESG strategies and cultures. Plus, see exactly where you fall on the 5 Stages of ESG Maturity Model.