In recent years, climate change has emerged as one of the most pressing global challenges. Its far-reaching effects are felt across the globe, from natural ecosystems to the very foundations of our economies. According to the Intergovernmental Panel on Climate Change (IPCC), global temperatures have risen by approximately 1.2 degrees Celsius since the pre-industrial era, and this upward trend is expected to continue unless immediate action is taken¹.

Businesses find themselves at the intersection of environmental responsibility and financial sustainability. The consequences of climate change, ranging from extreme weather events to shifts, have the potential to disrupt industries and reshape the competitive landscape. In fact, a report by the Global Risk Institute warns that climate-related risks could result in losses amounting to trillions of dollars for financial institutions and businesses worldwide if mitigation and adaptation strategies are not implemented promptly². As a result, the business world is increasingly recognising the need to address climate-related risks and seize opportunities for a more sustainable future.

The Need for Climate Risk Assessment

Climate risk assessment has become an urgent imperative for businesses worldwide due to the stringent laws and regulations recently put in place. With several laws coming into effect between 2023 and 2025, businesses are now mandated by law to transparently report their climate risk assessments. These reports are not just recommended; they are legally required, making timely climate risk assessment a top priority for all.

- EU’s Green Taxonomy will broaden its reach in 2023-2024, impacting financial/non-financial firms and products under CSRD and SFDR, mandating them to disclose their environmentally-friendly activities’ financial details.

- By 2024, EU’s CSRD, to create double materiality principle for both short- and long-term climate risk reporting.

- Around 2024-2025, US SEC Climate Disclosures will target US public firms, emphasizing TCFD standards for annual 10-K filings and assessing climate risks or opportunities on financial statements.

- Meanwhile, Canada’s CSA Proposal will require public firms to disclose according to TCFD pillars, without compulsory scenario or transition plan disclosures.

- In the UK, regulations mandate large companies and financial institutions to align with TCFD recommendations by 2025, enhancing transparency on climate-related risks and opportunities.

As businesses recalibrate their strategic priorities, embedding climate risk management becomes a non-negotiable. Recognising the growing importance of climate risk management, it is vital to unpack the specifics of climate risk. By doing so, businesses can craft informed strategies that align with both regulatory requirements and the evolving environmental landscape.

What are climate risks?

Physical risks: These encompass potential damage to assets and operations due to short- or long-term climate change events or hazards. The IPCC highlights that we are currently observing significant changes in climate patterns, such as rising average sea levels, increasing ocean acidity, and alterations in the frequency and intensity of droughts and floods. In the future, we are set to face heightened risks that will vary based on the extent of global warming, including increased temperature extremes, faster sea level rise, and melting ice caps⁴.

Transition risks: These relate to the costs and challenges of shifting to a low-carbon economy. As highlighted by UNEP-FI, the current impact of transitioning to a low-carbon economic model on stakeholders is relatively mild. Yet, as we progress, economic entities will be compelled to adopt a low-carbon approach, influenced by societal behavioural shifts and regulatory pressures to reduce emissions⁵.

Different industries perceive and experience climate risks in varied ways. For instance, the energy sector faces challenges related to moving towards renewables⁶, while the real estate domain is contending with the repercussions of rising sea levels⁷. Such variations amplify the significance of industry-specific climate risk evaluations and adaptive strategies.

TCFD as Major Framework for Assessing Climate-Related Risks and Opportunities

Established in 2015, the TCFD provides a robust framework for businesses to assess and report on climate-related risks and opportunities. By aligning financial strategies with climate objectives, it fosters transparency and accountability, making it indispensable for both companies and investors. For the latter, TCFD offers a standardised methodology to assess climate risks, aiding in the identification of sustainable investment avenues.

Central to the TCFD are four pivotal areas devised to amplify climate disclosures for businesses:

- Governance: This pertains to how an organisation oversees and integrates climate-related risks and opportunities within its governance structure.

- Strategy: A deep dive into the current and potential ramifications of climate-related challenges and prospects.

- Risk Management: An examination of the processes an organisation deploys to identify, assess, and manage climate-centric risks.

- Metrics and Targets: The adoption of specific metrics and targets to gauge and manage pertinent climate-related risks and opportunities.

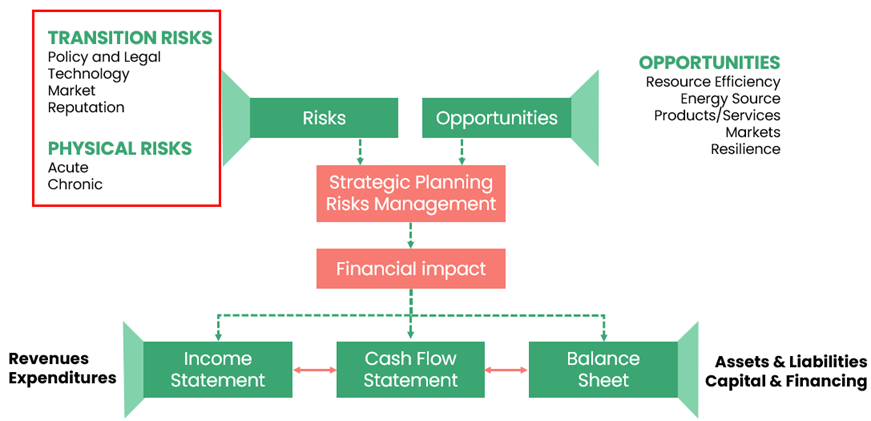

Figure 1 – TCFD framework⁸

Benefits of Using the TCFD Framework

The TCFD framework presents a multitude of benefits, ushering businesses towards sustainable and competitive practices. Beyond merely addressing climate risks, it equips enterprises to seize opportunities in our ever-changing global environment, laying the groundwork for informed financial planning. At its core, the TCFD aims to enhance our grasp of long-term climate risks. By spotlighting the financial aspects of climate risk, it ensures businesses remain resilient amidst environmental uncertainties. Its primary objective is to help businesses understand how climate risks can affect their finances. It provides a clear view of how these factors might influence their financial strategies and decisions.

Figure 2 – Climate-related risks, opportunities and Financial impact⁹

Figure 2 – Climate-related risks, opportunities and Financial impact⁹

The TCFD’s pioneering work in promoting climate-related financial disclosures has catalyzed the development of other frameworks like the TNFD, which extends similar disclosure principles to nature-related financial risks and opportunities¹⁰.

Limitations of TCFD

While the TCFD framework is a valuable tool for enhancing climate-related financial disclosures, it does have some limitations. These include its voluntary nature, potential challenges in data availability, and the need for further standardisation in reporting practices. However, it still serves as a crucial step forward in fostering transparency and climate resilience within the business community.

Conclusion

Climate change impacts global business, urging a shift in company strategies and responsibilities. This change demands updated business models and investments. Adopting structured frameworks like TCFD helps in addressing climate risks effectively. TCFD not only aids in regulatory compliance but also provides strategic insights for creating sustainable and resilient business models.

At Cority, we use the TCFD framework to provide tailored climate risk assessments for businesses, helping them balance environmental and financial goals. Mastering climate risk management is more than an operational need; it’s a key strategic asset. Cority offers expertise to help businesses navigate through climate risk challenges efficiently.

1 IPCC Special Report on Global Warming of 1.5°C

2 Global Risk Institute Report on Climate Change Risks

3 More information about EU Taxonomy, CSRD, US SEC, CSA please refer to the respective countries’ financial regulatory authorities or recent publications on these regulations

6 EU Strategy for Energy Crisis

7 Sea level rise affecting housing

10 TNFD news