Materiality in ESG reporting helps companies identify which sustainability issues matter most to their business and stakeholders. As stakeholders demand greater transparency and accountability, materiality has become a key concept — it’s based on the idea that not all sustainability issues are equally important, and companies should focus reporting efforts on what’s most material.

There are different types of materiality in ESG, including single materiality, impact materiality, and double materiality, each with their own benefits and limitations.

In this article, we will explore the concept of materiality in sustainability reporting, and discuss the different types of materiality and how they are used in different reporting standards.

What is single materiality?

Single materiality is a type of materiality that considers the impact of sustainability issues on a company’s financial performance. Sustainability issues are considered material only if they could have a significant financial impact on the company. Single materiality is often used in traditional financial reporting frameworks and is still commonly used in sustainability reporting by some companies and reporting standards.

Benefits: single materiality provides a clear and straightforward way to determine which sustainability issues to report on, and it helps companies prioritize their reporting efforts on the issues that are most important for their financial performance.

Limitations: single materiality may overlook sustainability issues that are important to stakeholders but do not have a direct financial impact on the company.

What is impact materiality?

Impact materiality is a type of materiality that considers the impact of sustainability issues on a company’s stakeholders and the broader society. It recognizes that sustainability issues can have significant social and environmental impacts that are not always reflected in a company’s financial statements.

Benefits: impact materiality provides a more holistic view of sustainability performance, and it helps companies identify and prioritize sustainability issues that are important to their stakeholders and society.

Limitations: impact materiality can be difficult to measure the impact of sustainability issues accurately, and it may be subjective and open to interpretation.

What is double materiality?

Double materiality is a type of materiality that considers the impact of sustainability issues on a company’s financial performance, as well as the impact of the company’s activities on the broader economy and society. It recognizes that a company’s sustainability performance can affect not only its own financial performance but also the broader economic and social systems in which it operates.

Benefits: double materiality provides a more comprehensive and transparent view of sustainability performance, and it helps companies and stakeholders understand the broader implications of sustainability issues beyond the company’s immediate financial performance.

Limitations: double materiality can be more complex to apply than single or impact materiality, and it may require more extensive data collection and analysis.

Materiality in ESG and the Current Sustainability Reporting Standards Landscape

The current sustainability reporting standards landscape is witnessing two significant developments that can affect a company’s materiality assessment.

The first development is the creation of the European Sustainability Reporting Standards (ESRS) based on double materiality for a multi-stakeholder audience, including investors, led by GRI and the European Financial Reporting Advisory Group (EFRAG).

The second development is the standards for the disclosure being drafted by the International Sustainability Standards Board (ISSB) under the International Financial Reporting Standards (IFRS) Foundation. The IFRS Foundation’s focus is on meeting the information needs of investors. Therefore, the ISSB uses the same definition of ‘material’ that is used in IFRS Accounting Standards – that is, information is material if omitting, obscuring or misstating it could be reasonably expected to influence investor decisions.

How does materiality connect to CSRD?

The Corporate Sustainability Reporting Directive (CSRD) is a new EU regulation that aims to improve the way companies report sustainability information. It updates and strengthens the rules introduced by the Non-Financial Reporting Directive (NFRD) adopted in 2014. The CSRD incorporates the concept of double materiality, requiring companies to report on how sustainability issues might create financial risks for the company, as well as the company’s impacts on people and the environment.

The CSRD mandates the adoption of the ESRS, which provide clarity to companies about what they have to disclose and establish a reporting framework allowing companies to report in a systematic, credible, and comparable manner about their sustainability performance.

While the EU supports the objectives of the ISSB standards to set a global baseline for sustainability reporting, the EU’s standards should integrate the content of ISSB standards to the extent that it is consistent with the EU’s legal framework and the ambitions of the European Green Deal.

Simplify Materiality Assessment & ESG Reporting

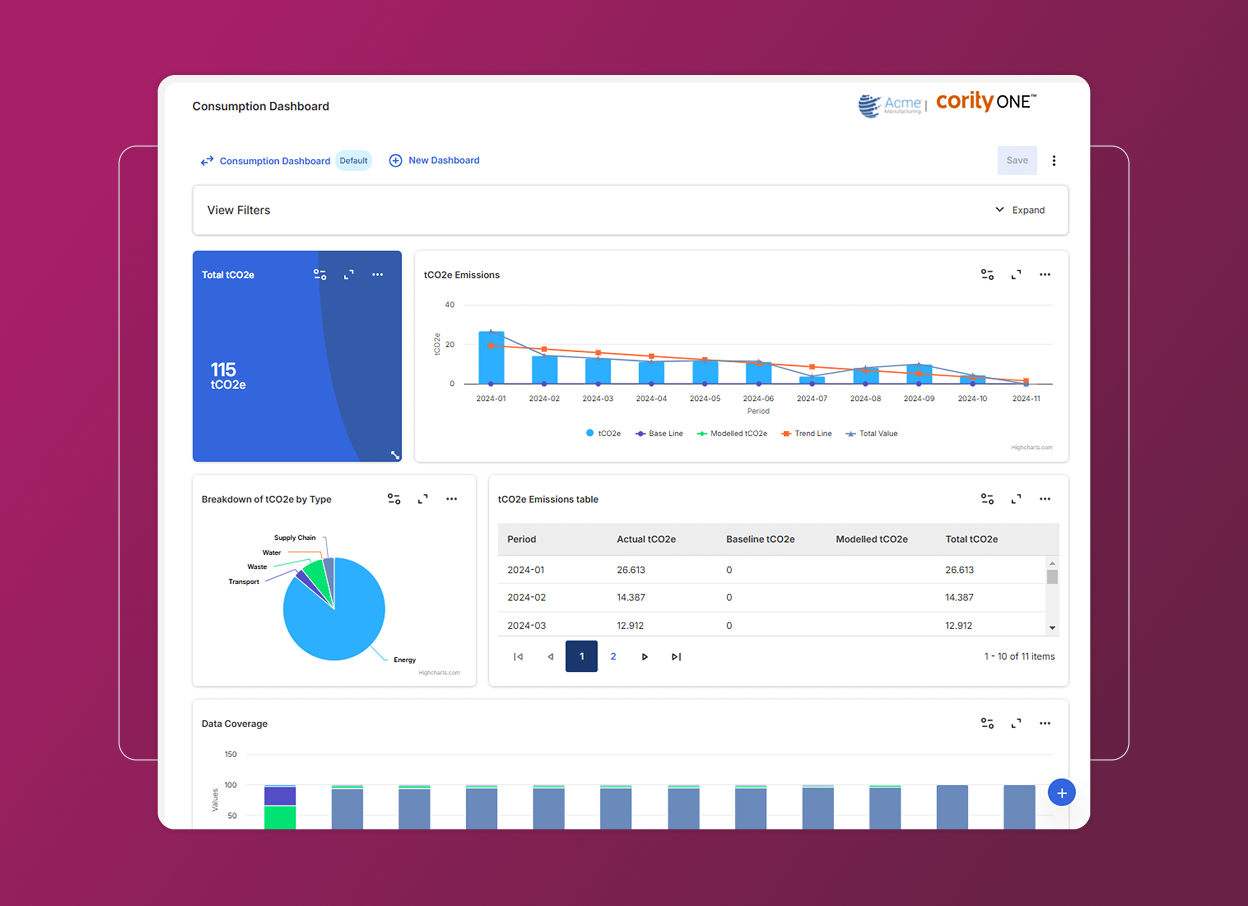

Whether you’re conducting your first double materiality assessment or scaling ESG reporting across a portfolio, the right software makes the difference.

Cority’s Sustainability Cloud helps companies collect validated data across stakeholders and suppliers, align with frameworks like CSRD, GRI, and SASB, and turn ESG insights into action.

For private equity and institutional investors, Cority’s ESG Investor software centralizes portfolio-wide ESG data collection, benchmarking, and reporting — delivering the investor-grade disclosures your stakeholders expect.