The Australian Sustainability Reporting Standards (ASRS) were issued by the Australian Accounting Standards Board (AASB) in September 2024. Known as AASB S1 and AASB S2, they are officially here and they’re changing the way Australian businesses disclose and confront climate risks. Designed for interoperability with international reporting frameworks, these rules bring greater transparency and consistency to how companies communicate climate-related financial information while streamlining reporting activities.

For many organizations, the road to compliance will be challenging. But with an integrated, cross functional strategy and robust digital systems, ASRS can also become a catalyst for effective risk mitigation, opportunity development and long-term resilience. In this blog we aim to provide an overview of what you need to know about these climate disclosures and how your company can effectively prepare for compliance under the AASB S2.

What Are The Australian Sustainability Reporting Standards (ASRS)?

Australia’s sustainability reporting framework is underpinned by two key standards issued by the Australian Accounting Standards Board (AASB):

- AASB S1 (General Requirements for Disclosure of Sustainability-related Financial Information): This standard relates to all sustainability-related risks and opportunities. The application of AASB S1 is voluntary.

- AASB S2 (Climate-related Disclosures): This is the mandatory standard, setting out requirements specifically for disclosing information about climate-related risks and opportunities.

While based on international standards (IFRS S1 and S2), they include some Australian-specific requirements. For example, scenario analysis must include two temperature pathways aligned with science-based climate goals: one at 1.5°C and another that exceeds 2°C, to address both transition and physical risks.

AASB S2 Reporting Timeline: Who Reports and When?

Not every company will be affected right away. Reporting depends on two main factors:

- Whether your organization must lodge a financial report under the Corporations Act 2001 (Chapter 2M)

- Your size or emissions threshold

If both apply, you’ll fall into one of three reporting groups.

*To fall into a specific Group, your entity must meet at least two out of the three size criteria (Assets, Revenue, Employees) listed below, OR meet the specified National Greenhouse and Energy Reporting (NGER) or Asset Owner criteria.

Reporting Group | Financial Year Commencing On or After | Consolidated Revenue Threshold (or more) | Consolidated Gross Assets Threshold (or more) | FTE Employees Threshold (or more) | Other Criteria Included |

Group 1 | 1 January 2025 | $500M | $1B | 500 | NGER Reporters exceeding the high publication threshold (50 ktCO2-e Scope 1 & 2 emissions). |

Group 2 | 1 July 2026 | $200M | $500M | 250 | All other registered NGER reporters; or Asset Owners (RSEs, Registered Schemes, Retail CCIVs) with assets of $5 billion or more. |

Group 3 | 1 July 2027 | $50M | $25M | 100 | N/A |

SMEs Excluded: Most small and medium-sized businesses are exempt, as Group 3 thresholds match those for large proprietary companies.

Scope 3 Relief: Scope 3 emissions reporting is optional in the first year and becomes mandatory from the second reporting period.

All disclosures will be part of the company’s annual sustainability report, lodged with the Australian Securities and Investment Commission (ASIC) alongside the financial statements.

AASB S2 Disclosure Requirements: The Four Pillars

Disclosures under AASB S2 are built around four key pillars, the same structure used by the Task Force on Climate-related Financial Disclosures (TCFD).

- Governance: Processes, controls, and procedures used by the board and management to monitor and oversee climate-related risks and opportunities.

- Strategy: Material risks and opportunities, the current and anticipated financial effects, and disclosure of Climate Transition Plans (CTP).

- Risk Management: Processes for identifying, assessing, prioritizing, and monitoring risks, and how these integrate into the overall risk management structure.

- Metrics and Targets: Disclosure of Scope 1 and Scope 2 GHG emissions (location-based) from Year 1, and material Scope 3 GHG emissions from Year 2. Financial institutions must also disclose financed emissions.

Essentially, companies must share information that could reasonably affect their cash flow, access to finance, or cost of capital over the short, medium, or long term.

How to Prepare for AASB S2 Climate Reporting

At Cority, we understand that AASB S2 compliance can be overwhelming, from gathering emissions data to running scenario analyses and ensuring assurance-ready reporting. We strongly recommend that companies:

- Understand Applicability and Timing: Identify which reporting group your entity falls into and map out your first mandatory reporting period.

- Perform a Gap Analysis: Compare current practices against the ASRS/AASB S2 requirements.

- Build Internal Capacity: Start training the Board, executive, and management on the new requirements.

- Align Governance and Strategy: Embed climate risk management into business strategy and decision-making.

- Strengthen Data and Systems: Implement reliable systems and tools to capture, manage, and verify your Scope 1, 2, and 3 data.

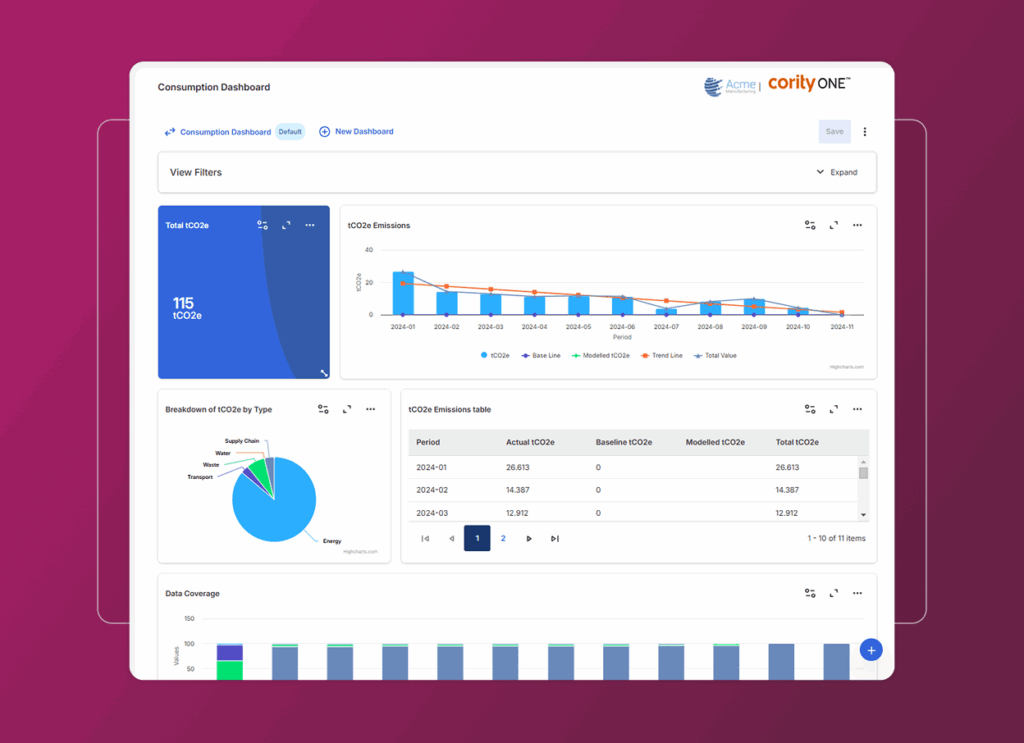

- Use an Integrated Platform: Simplify reporting with unified data, intelligent automation, and real-time dashboards to help understand and visualize climate risk exposure across the value chain.

Frequently Asked Questions About AASB S1 & AASB S2

The due date for the first resulting report depends on the entity’s financial year end. For Group 1, the earliest due date for a Group 1 entity will be in the first half of 2026.

Yes, assurance is a core component. Limited assurance is required from the start over specific disclosures like Scope 1 and 2 emissions and governance requirements. The goal is to achieve reasonable assurance over all climate disclosures by financial years starting on or after 1 July 2030.

The legislation includes a transitional limited immunity period for certain disclosures, aiming to ease the burden during initial adoption. For a fixed period of three years (from 1 January 2025), actions related to disclosures of Scope 3 emissions, scenario analysis, and transition plans will generally be limited to regulator-only actions.

Australian entities that meet ASRS thresholds must report locally, even if the parent company already reports globally. A corporate-level consolidated report will not satisfy the requirement.

Group 3 companies can opt out of full reporting if they determine there are no material climate-related financial risks or opportunities. However, they must publish a short statement explaining how that conclusion was reached, with director sign-off and an auditor report.

Moving Beyond AASB S2 Compliance to Strategic Advantage with Cority

While compliance is mandatory, AASB S2 offers significant benefits, including aligning with global peers, improving consistency and clarity, enhancing investor transparency, and ultimately driving sustainable business performance and long-term resilience.

With the right systems in place, sustainability reporting can:

- Improve consistency and credibility of climate data

- Build investor trust and transparency

- Strengthen governance and decision-making

- Enhance long-term business resilience

Why Software Matters for AASB S2 Reporting

Implementing AASB S2 climate-related disclosures involves managing vast amounts of data across teams, systems, and supply chains. Manual processes and spreadsheets simply won’t keep up.

With Cority’s sustainability software, you can:

- Centralize and automate data collection across business units and value chains

- Calculate GHG emissions in real time, aligned with global standards like the GHG Protocol

- Support climate scenario analysis and track progress against transition plans

- Generate audit-ready reports that integrate seamlessly with financial data

- Visualize climate risk exposure across the value chain

- Understand implications of climate change across the value chain

- Prepare your business to thrive in a changing world

Our solutions help you move beyond compliance, giving you visibility, efficiency, and the confidence that your data can withstand scrutiny. Cority can help you assess your readiness, close data gaps, and implement digital solutions that make your reporting faster, easier, and more accurate. Learn how Cority can help you prepare for AASB S2 compliance.

Sources

AASB S1 General Requirements for Disclosure of Sustainability-related Financial Information – Australian Sustainability Reporting Standard

AASB S2 Climate-related Disclosures – Australian Sustainability Reporting Standard

Australian sustainability reporting legislation and standards finalised – KPMG

Mandatory sustainability reporting in Australia: Your questions answered – BDO Australia

Australian Sustainability Reporting Standards: Foundations and Future – Actuaries Institute

Sustainability reporting standards and legislation finalised: mandatory sustainability reporting begins – PwC Australia

Overview of Australian Sustainability Reporting Standards – Australian Accounting Standards Board

Treasury Laws Amendment (Financial Market Infrastructure and Other Measures) Bill 2024 – Parliament of Australia

AASB Exposure Draft SR1 Australian Sustainability Reporting Standards – Disclosure of Climate-related Financial Information – Australian Accounting Standards Board